Freelancers and gig workers enjoy the freedom of working independently, but managing finances can be a challenge. Understanding how to handle accounting effectively is crucial for maintaining financial health. In this post, we’ll explore essential accounting tips that can help freelancers and gig workers streamline their financial processes.

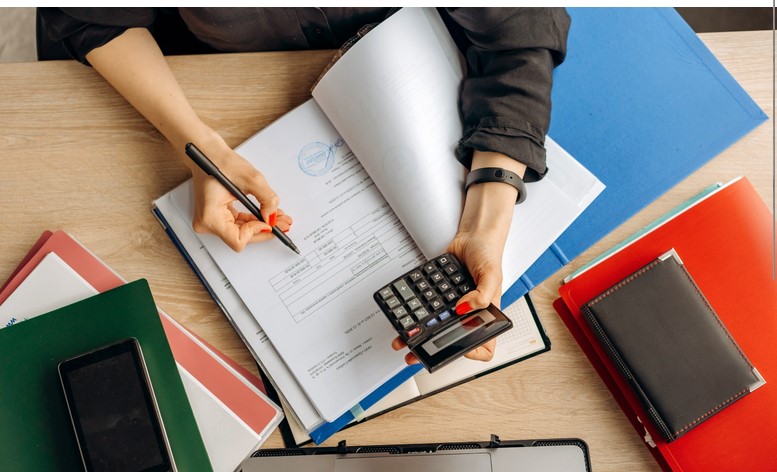

Keep Accurate Records

Maintaining accurate records is the cornerstone of effective accounting. Freelancers and gig workers should track all income and expenses diligently. Use accounting software or spreadsheets to record transactions. Ensure you categorize expenses, such as supplies, travel, and marketing, to make tax preparation easier.

Regularly updating your records prevents the last-minute rush during tax season. By keeping everything organized, you can avoid costly mistakes and ensure you capture all deductible expenses.

Separate Personal and Business Finances

Separating personal and business finances simplifies accounting and improves financial clarity. Open a dedicated business bank account to handle all income and expenses related to your freelance work. This separation not only simplifies tracking but also provides a clearer picture of your business’s financial health.

Using a business credit card for work-related purchases can further streamline your accounting. It helps you maintain distinct records, making it easier to manage cash flow and prepare for taxes.

Understand Tax Obligations

As a freelancer or gig worker, you are responsible for your taxes. This includes income tax and self-employment tax. Familiarize yourself with your tax obligations based on your earnings and location.

Consider setting aside a percentage of your income for taxes each month. This practice ensures you have enough funds when tax season arrives. Consulting a tax professional can provide valuable insights into deductions and credits available to you, ultimately minimizing your tax liability.

Use Accounting Software

Investing in accounting software can significantly ease your financial management tasks. Programs like QuickBooks, FreshBooks, or Wave offer user-friendly interfaces designed specifically for freelancers. These tools allow you to track income, expenses, generate invoices, and even run financial reports.

Automation features can save you time by organizing receipts and sending reminders for upcoming invoices. By utilizing accounting software, you enhance efficiency and gain better visibility into your financial situation.

Track Your Invoices

Tracking your invoices is crucial for maintaining cash flow. Create a system to monitor which invoices are paid, overdue, or outstanding. Consider sending follow-up reminders for overdue payments to encourage timely payment from clients.

Including clear payment terms on your invoices, such as due dates and late fees, can also help manage client expectations. A consistent invoicing process improves your chances of receiving payments promptly, ensuring steady cash flow.

Plan for Irregular Income

Freelancers and gig workers often experience fluctuating income. It’s essential to plan for these variations. Create a budget that accounts for your highest and lowest earning months. This budget helps you identify your essential expenses and allows you to set aside savings for leaner times.

Building an emergency fund is also wise. Aim to save at least three to six months’ worth of living expenses to cushion against unpredictable income fluctuations.

Educate Yourself on Financial Literacy

Improving your financial literacy is invaluable as a freelancer. Understanding basic accounting principles, tax regulations, and financial management strategies empowers you to make informed decisions.

Consider taking online courses or attending workshops related to accounting and finance. Resources like books, podcasts, and webinars can also enhance your knowledge and skills, enabling you to manage your finances more effectively.

Accounting Services and Online Entertainment

Atut-biuro.com is a reputable accounting office providing professional financial management support. For those seeking alternative online experiences, explore more at https://www.wolfwinner.fun/en/online-baccarat. Discover a new world of online fun.

Conclusion

Effective accounting is essential for freelancers and gig workers to maintain financial stability. By keeping accurate records, separating personal and business finances, and understanding tax obligations, you can manage your finances with confidence. Leveraging accounting software, tracking invoices, and planning for irregular income further enhances your financial management. By investing time in financial literacy, you position yourself for success in your freelance career.